Latest posts by Dermot Davitt (see all)

- A celebration of speed and sumptuous Qatari hospitality - October 8, 2023

- ‘Pura vida’ – A captivating Costa Rican experience - March 23, 2023

- Rum, food and music – a cultural tour of discovery in Jamaica - March 1, 2023

The digital speed clock in the train carriage ticks past 303 kilometres per hour, and outside the countryside and towns of Jiangsu province in eastern China flash by. We’re heading for Zhenjiang, a Tier 3 level prefecture city, to see how luxury brands are penetrating new markets within this vast country.

I’m in the company of L’Oréal Luxe China executives, as the company deepens its investment in this key market. Places such as Zhenjiang are among the new wave of cities being targeted by L’Oréal and other luxury goods companies in China, making this an especially fascinating visit.

We left from Shanghai Hongqiao High Speed railway station (pictured above) this morning, a vast, sprawling temple to the travel boom in China. The main concourse is a good ten-minute walk from one end to the other, and on the way one sees how leading Chinese and international brands are tapping into surging domestic travel. Relay is here, as are many fashion brands plus a myriad of packaged food outlets aimed at the traveller requiring a last-minute gift.

One of the many stores at Shanghai Hongqiao railway station operated under the CDF name

The dominant retail name though is China Duty Free Group, which operates many of the branded stores under its CDF banner, from Disney to Crocs. We’re here at a relatively quiet time and there are thousands of people arriving and departing, giving a clue as to how busy it gets at peak times or during the Chinese New Year travel season.

With the rapid train service (300km/h plus on average) we’re in Zhenjiang, 250km away, in under an hour.

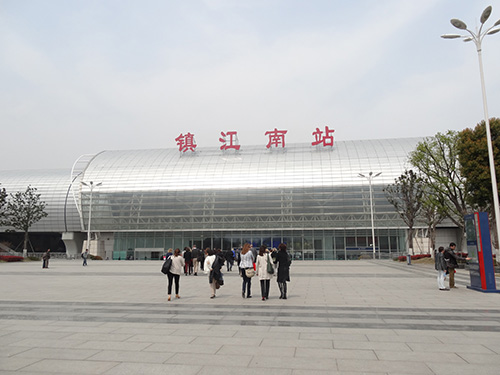

And when we arrive, it doesn’t take long to see how this might be an attractive new market. There’s what appears to be a construction boom here, with a recently built station (pictured above) and newly paved roads and apartment blocks close by. The city centre is older and in need of modernisation but by the number of cranes dotted around, that’s not too far off.

Lower tier cities are now the boom locations for luxury brands’ growth in China, as L’Oréal Luxe China General Manager Stephan Rinderknech tells us.

“Three-quarters of urban Chinese live outside Tier 1 and 2, and that’s a vast market,” he notes. “The disposable income of the lower tier citizen is generally higher than in the main cities too, because the cost of living in the Tier 1 and 2 cities is so much higher. The emergence of the middle class and that rising disposable income has helped fuel the new wave of shopping mall development in the lower tiers since 2009.

“The penetration rates of digital media among consumers in the lower tiers are also very high, with the online daily reach at 80% of the population compared to 72% in Tier 2. It is also reflected in outbound travel: 45% of Mainland visitors to Hong Kong are from the lower tiers. That makes it important for us to reach them in their home markets before they even travel. As well as all that, there’s the drive to trade up in branded purchases, a drive that is stronger even in the lower tiers than in the top tiers.”

All of that represents a huge opportunity for L’Oréal Luxe, which has put its focus on developing Lancôme plus on Chinese traditional medicine brand Yue Sai.

We see both on show (Lancôme above) in key locations within the Zhenjiang Yaohan department store, where the focus is very much on consultation and advice, as well as product sales. The counters and units are the match of those anywhere else in the impressive beauty group’s network, underlining its ambition to “plant the banner of luxury in China,” in Rinderknech’s words.

He says: “Back in the late 1990s we installed the first Lancôme counter in Hangzhou, which was then not an easy decision, as it was unclear how well it would work in an emerging city. But things changed rapidly: today it’s one of the top five counters in the world for Lancôme.”

That’s a development the company hopes will see mirrored in Zhenjiang, a city of 3.1 million people, and where textiles, paper and chemicals are all strong industries. Given the boom in construction, and in the rising disposable incomes of the population thirsty for brands, you would not bet against it.

*Note: I’m in China as part of a broader trip with L’Oréal Luxe for leading newspapers and magazines in Europe, with The Moodie Report representing the travel retail media. On Monday in Hong Kong we heard the corporate vision as outlined by L’Oréal Luxe President Nicolas Hieronimus. Crucially there, travel retail was placed high on the agenda – a first for the company at this media event – with dynamic Managing Director Travel Retail Worldwide Barbara Lavernos spelling out just how vital the channel is for the luxury division. We’ll report more fully on their comments (embargoed for now) in coming days, plus those of L’Oréal Group Chairman & CEO Jean-Paul Agon, who hosts a major press conference for Chinese and international media on Wednesday.